Understanding where your money goes

…is probably the most important part of your journey toward greater understanding, control and money efficiency.

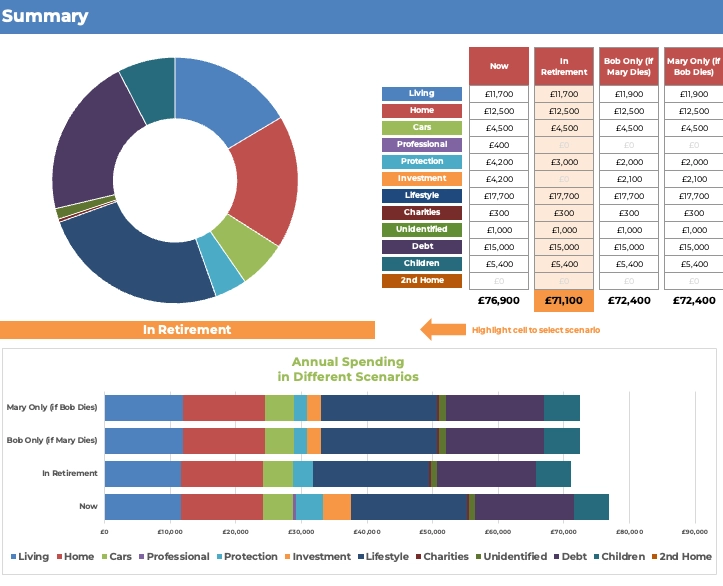

However, knowing what you spend today is only the start. With this clarity, our spreadsheet allows you to compare up to three additional scenarios.

Want to know if your retirement plan is on track? You need to know what you’re aiming for.

Want to know if you need more life insurance? Consider what costs your partner will have if you’re not around.

Feel free to download our Excel template below.

The video on the left explains how we intend it to be used.

Download Template

Production

Production